Hail season is about to descend on Central and South Texas – every year there are storms that cause millions of dollars in damage to Texan homes. There are things that you should do before the storm comes to ensure that you are protected and ready, and they all have to do with your insurance policy. Homeowners need to know what type of policy they have, how much their deductible is, if they have code coverage upgrade, whether the policy waives cosmetic damage, and understanding what your policy does (and does not) cover.

What type of policy do I have? RCV versus ACV

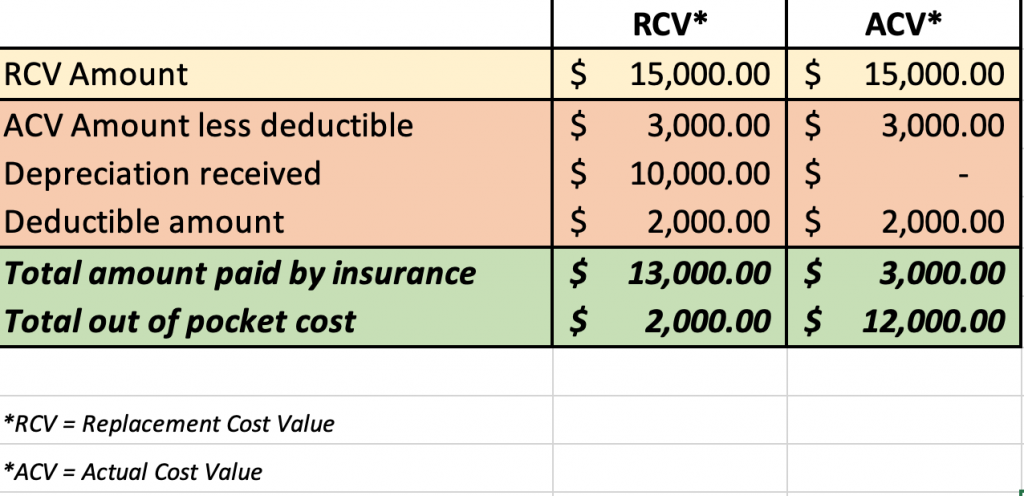

There are two basic types of policy – Replacement Cost Value (RCV) and Actual Cash Value (ACV), and you want to make sure you have an RCV policy. While the premium on an ACV policy is likely less, which makes it tempting, the coverage can be almost non-existent, especially on older roofs. With and RCV policy, the insurance pays to replace that roof at current market value, less your deductible, of course. This is usually done through two payments – they will pay you the cash value of your damages first (less your deductible), and then when the work is completed, they will pay you your depreciation. Depreciation just means the portion of your roof that has already been used. On an ACV policy, your insurance company only pays you the cash value of your roof less your deductible – the depreciation is forfeited!

Here are two examples of a roof that has a 30-year shingle and is 20 years old.

How much is my deductible?

You should be able to check your policy to see what your deductible is. If you cannot find it, contact your agent and they should be able to tell you. Most policies anymore are 1% of your home value – so if your home is valued at $240,000, your deductible would be $2,400. Some policies are 2% – 5% of your home value – you for sure want to know! Again, sometimes people pick a hire deductible to lower their premium, but when you go to use it, it can be shocking how little coverage you have. In the scenario above, if you had a 3% deductible it would be $7,200 – our average roof is $12,500, so that would mean your insurance company would only be covering $5,300 of your roof – not even half!

Another thing to look for is if your deductible is based on your home value, make sure that your home is value correctly in your policy. This is a ridiculous example, but let us say your insurance added and extra zero to your home value on accident and shows its value at $2.4M. If your deductible is 1%, the dollar amount is $24,000. Basically, you would have no coverage for a $12,500 roof if that were the case. Even if the value is wrong and is an error, the policy amount will stand. They will correct your policy after the fact, but it will do you no good on your claim. It is more common for the home value to be off by a smaller amount like $30,000, but that still changes your out-of-pocket expense by $300.

Code Upgrade Coverage

Sometimes an older roof does not meet code requirements, and it’s been “grandfathered” in. When you go to put a new roof on, you must follow the applicable building codes. Most insurance policies cover code upgrades, but some do not. Where this comes into play the most often is with drip edge (the strip of metal around the perimeter of your roof that keeps your fascia/trim from rotting out). Drip edge was code in 2008, but no one really followed it until 2016. Many homes, especially in new subdivisions prior to 2016, do not have drip edge. If your policy does not cover code upgrades, you may have to come out of pocket to meet code. One municipality code I know of requires all roofs to have 5/8” decking (aka sheathing); back in the 1970’s, 3/8” decking was code, and many older homes have the thinner decking. If you are required to redeck your entire house and come out of pocket, it could cost you thousands of dollars. These are good things to be aware of beforehand so that you can ensure that your policy includes it.

Cosmetic Damage

Especially if you have a metal roof, you should read your policy to know if it reads that hail damage is cosmetic (unless it breaks the metal). Insurance companies give discounts off your premium for what they call a Class IV roof (impact resistant) – generally Class IV roofs are standing seam metal, but there are Class IV shingles as well. When you claim a Class IV roof, you are generally basically signing a waiver that you agree that your policy does not cover cosmetic damage. After a hail event, it may look like your roof has a case of the chicken pox, but it will not be covered. If it is damaged/broken, insurance would cover it, but it would not cover “pock marks.”

For this reason, I generally do not recommend impact resistant shingles to my customers, and I caution anyone with any type of roof claiming that Class IV discount. If you do, just make sure you are clear on what they will and will not cover, and make sure that you can live with it.

Does my insurance cover all damages?

The quick answer is no, your insurance does not cover all damages. Some homeowners believe that just because it is time to replace their roof, their insurance will cover it, and that simply is not true. Insurance is meant to cover unforeseen, uncontrollable events – generally referred to as “Acts of God.” Whether or not you believe in God doesn’t change your coverage!

Insurance generally covers:

- Hail

- Wind, including wind driven rain (it gets blown in)

- Falling objects

- Hurricanes/Tornados/Derechos

Your insurance does not cover:

- Normal wear and tear (age)

- Workmanship issues (caused by a poor installation)

- Rodent damage

- Homeowner negligence (for example, if you know your roof has been leaking for 3 years and now it rotted the decking and framing, your insurance is not going to cover the rotten structure)

Things your policy likely does not cover (you should check):

- Flooding (generally this is a separate policy)

- Sewer backups

- Earthquakes

- Water leaks/broken pipes

- Acts of war

Summary

Once the storm strikes, you cannot alter your insurance coverage, so it is very important that you ensure that you are properly protected. I know that insurance documents can seem boring and tedious, but it is well worth your time to investigate. Your insurance agent should easily be able to answer all of these questions!